FAQs About Direct Hard Money Lenders Every Investor Should Read

Wiki Article

Browsing the Process of Acquiring Hard Cash Loans: What You Required to Know

Maneuvering the procedure of obtaining Hard money Loans can be intricate. Customers have to comprehend the one-of-a-kind attributes and terms connected with these lendings. Secret actions consist of collecting economic files and picking the ideal residential or commercial property for security. Assessing possible lenders is equally important. With high rates of interest and short payment durations, mindful consideration is required. What approaches can borrowers execute to ensure an effective experience with Hard money funding?Comprehending Hard Cash Car Loans: Meaning and Trick Includes

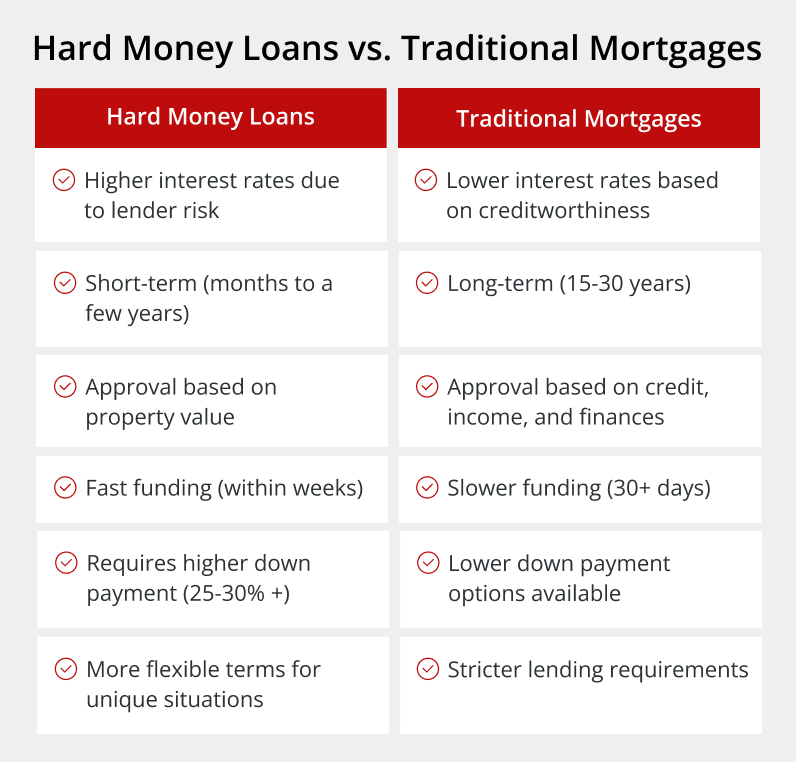

Hard money Loans serve as a monetary lifeline for debtors looking for fast accessibility to resources, specifically in property deals. These Loans are mostly safeguarded by the worth of the building, instead of the debtor's credit reliability. Commonly supplied by private financiers or firms, Hard cash Loans include high-interest prices and short settlement terms. They are frequently made use of for building flips, urgent renovations, or when standard financing is unattainable. Approval procedures are accelerated, enabling debtors to protect funding rapidly. Unlike standard home mortgages, Hard cash Loans rely heavily on security, making them a sensible option for investors that need swift funding options. Comprehending these qualities is important for debtors thinking about Hard money Loans for their monetary needs.The Application Refine: Steps to Safeguard a Difficult Money Car Loan

Protecting a tough money loan can be a structured procedure, particularly for those that comprehend the necessary actions included. Initially, a borrower needs to collect relevant monetary documents, consisting of income declarations and credit report. This financial background aids loan providers analyze the customer's capacity to pay back. Next off, the customer needs to determine an ideal residential or commercial property to make use of as collateral, as Hard money Loans are mostly safeguarded by property. As soon as the residential or commercial property is picked, the borrower submits a finance application along with the home information. Following this, lending institutions typically carry out a home evaluation to identify its worth. Ultimately, upon authorization, the borrower evaluates the finance terms prior to signing the agreement, finishing the application process effectively.Assessing Lenders: What to Seek in a Difficult Cash Lender

When assessing prospective lending institutions for a tough cash financing, what vital aspects should customers think about to ensure they choose a reliable partner? First, consumers must assess the lending institution's track record, trying to find reviews, testimonials, and effective study. Transparency is necessary; lenders must provide clear details regarding procedures and costs. Additionally, checking out the lender's experience in the Hard cash market can indicate their reliability and understanding of the market. Consumers ought to additionally consider the loan provider's responsiveness and consumer service, as efficient interaction can significantly influence the finance procedure. Understanding the loan provider's funding resources and their readiness to customize Loans to specific situations can help secure a productive partnership. A detailed assessment promotes an extra secure borrowing experience.Rates Of Interest and Terms: What Debtors Must Expect

Comprehending the landscape of rates of interest and terms is essential for borrowers seeking Hard money fundings, as these variables can substantially impact the general expense and feasibility of the financing. Hard cash Loans usually feature higher passion rates compared to conventional lendings, typically varying from 8% to 15%. The regards to these Loans are generally brief, typically between 6 months to 5 years, showing the short-term nature of the financing. In addition, lending institutions may require factors, which are ahead of time charges computed as a portion of the financing quantity. Customers should additionally understand potential early repayment charges and the significance of a clear payment plan. All these components must be carefully Web Site taken into consideration to assure a knowledgeable borrowing choice.Tips for Successful Loaning: Maximizing Your Hard Cash Funding Experience

For consumers aiming to maximize their Hard cash lending experience, cautious prep work and strategic planning are important. Recognizing the terms and conditions of the funding can protect against costly surprises later. Customers must additionally conduct comprehensive research study on possible lending institutions, comparing rate of interest prices, reputations, and fees. Developing a clear purpose for the lending, such as a particular investment job, enables for focused discussions with loan providers. Furthermore, having a solid leave approach in location can comfort lending institutions of the consumer's dedication to payment. Preserving transparent interaction and offering necessary documents promptly can promote a positive partnership with the loan provider, which may lead to extra positive terms in future purchases.

Often Asked Questions

What Kinds Of Residence Get Approved For Hard Money Loans?

The sorts of properties that certify for Hard money Loans normally consist of houses, business structures, fix-and-flips, and land. Direct Hard Money Lenders. Lenders analyze the residential property's value and possibility for earnings rather than the consumer's credit reliabilityExactly How Promptly Can I Receive Funds After Approval?

After authorization, debtors commonly obtain funds within a couple of days, depending on the lending institution's procedures and the customer's responsiveness. Quick turn-around is an essential benefit of Hard money Loans compared to conventional funding alternatives.

Can Hard Cash Loans Be Used for Business Qualities?

Hard money Loans can without a doubt be utilized for business homes. Capitalists commonly favor these Loans for their speed and versatility, permitting quicker accessibility to resources for purchasing or restoring different sorts of industrial realty.What Takes place if I Default on a Difficult Cash Finance?

If one defaults on a tough cash financing, the lender normally launches repossession procedures. The property might be seized, resulting in loss of equity and possible lawful repercussions, significantly influencing the customer's financial standing and credit score.Are Hard Money Loans Readily Available for First-Time Borrowers?

Hard cash Loans can be easily accessible to first-time customers, though terms may differ by read here lending institution (Direct Hard Money Lenders). These Loans frequently focus on residential or commercial property worth over credit report, making them a choice for those with limited loaning experienceNext off, the consumer needs to recognize an ideal property to use as collateral, as Hard cash Loans are largely protected by genuine estate. When evaluating possible lenders for a tough cash car loan, what vital elements should debtors think about official website to assure they select a credible partner? Comprehending the landscape of passion rates and terms is crucial for debtors looking for Hard money car loans, as these elements can considerably impact the general cost and expediency of the funding. Hard cash Loans commonly include higher passion prices compared to conventional car loans, usually varying from 8% to 15%. Hard money Loans can be easily accessible to new consumers, though terms may vary by loan provider.

Report this wiki page